Options Pricing & Greeks (Black–Scholes)

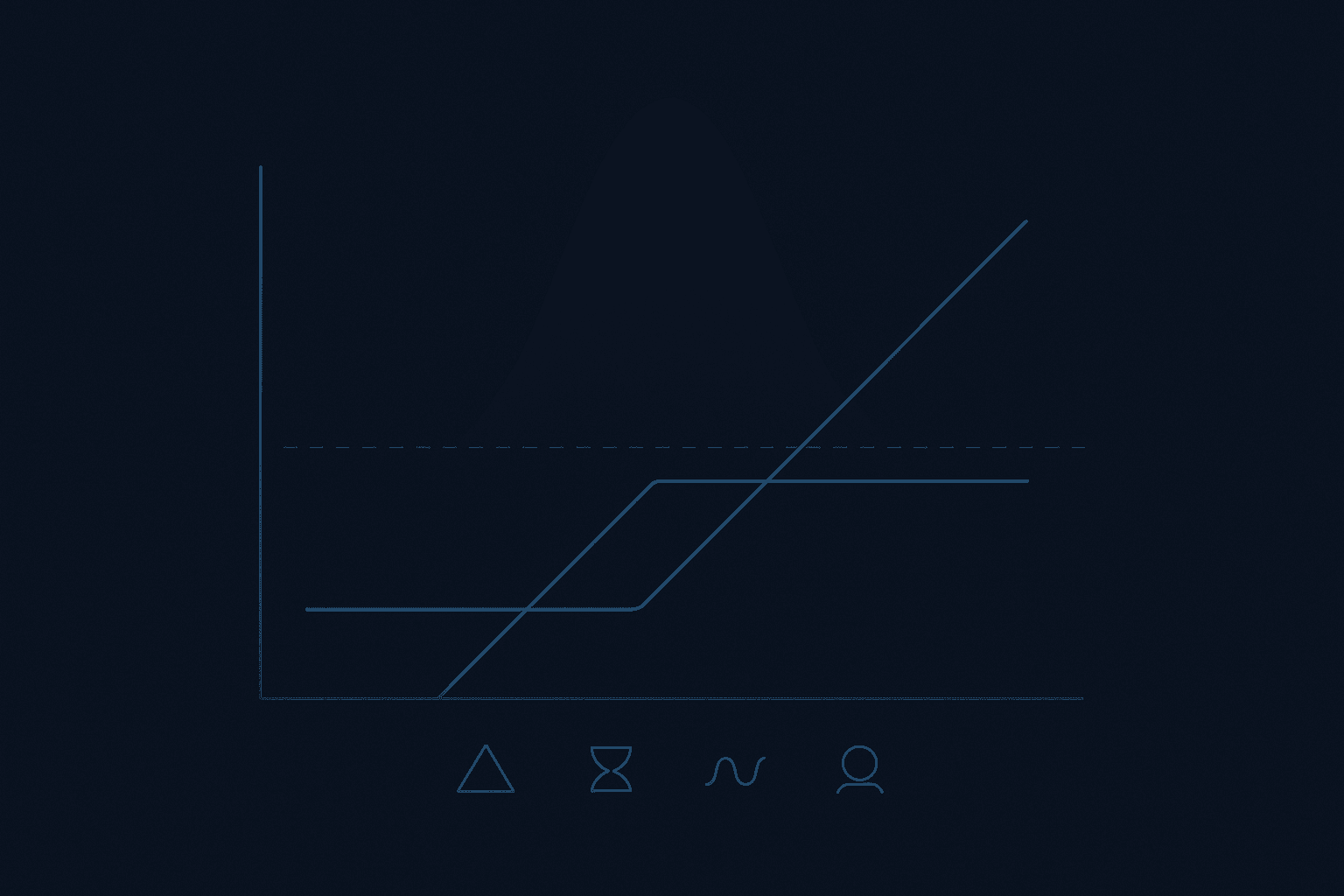

Get theoretical price, Δ, Γ, Θ (per calendar day), Vega (per 1%), Rho (per 1%), break-even and a payoff chart. If you know the market premium but not σ, leave it blank and provide the option price—the calculator solves implied volatility and updates all outputs.

Inputs

Θ is per calendar day. Vega/Rho are per 1% change. Current moneyness: ATM.

We use the dividend-yield variant (terms scale with e−qT) and show Θ per calendar day. Greeks and prices follow closed-form Black–Scholes.

Educational use only — models are estimates; markets include skew/smile and American exercise/discrete dividends not captured by B-S.

Quick how-to

- Choose Call or Put; set S, K, days, r% and q%.

- Enter σ% for theoretical results, or leave σ blank and enter a market premium to solve IV.

- Use payoff shading, P(ITM), and the what-if slider to explore scenarios.

Outputs

Payoff uses the premium you provided (market price if entered; otherwise theoretical).

Turn calculators into a trading routine

Pair these calculators with daily execution, live timing alerts, and the 2026 roadmap so every setup fits a bigger plan.

Daily Newsletter

Today’s Market. Today’s Edge.

Every trading day starts with noise. Our Daily Newsletter filters it down to what really matters—so you know where to focus and where to avoid risk. It’s the perfect companion to the stock you’re watching now.

Subscribe Daily NewsletterLive Signals

See It. Hear It. Act on Time.

When timing aligns, we broadcast the call—clear, precise, and right when it matters. No lag. No guesswork.

Plan the Year. Not Just the Trade.

Daily updates keep you sharp. Live broadcasts keep you fast. But strategy is built on foresight. The Annual Letter 2026 maps out the cycles shaping equities, commodities, and crypto for the year ahead. Investors worldwide rely on it as their compass.